Condo Insurance in and around Baltimore

Baltimore! Look no further for condo insurance

Insure your condo with State Farm today

- MD, DC, VA, DE, PA

Home Is Where Your Heart Is

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from theft, lightning, or freezing pipes.

Baltimore! Look no further for condo insurance

Insure your condo with State Farm today

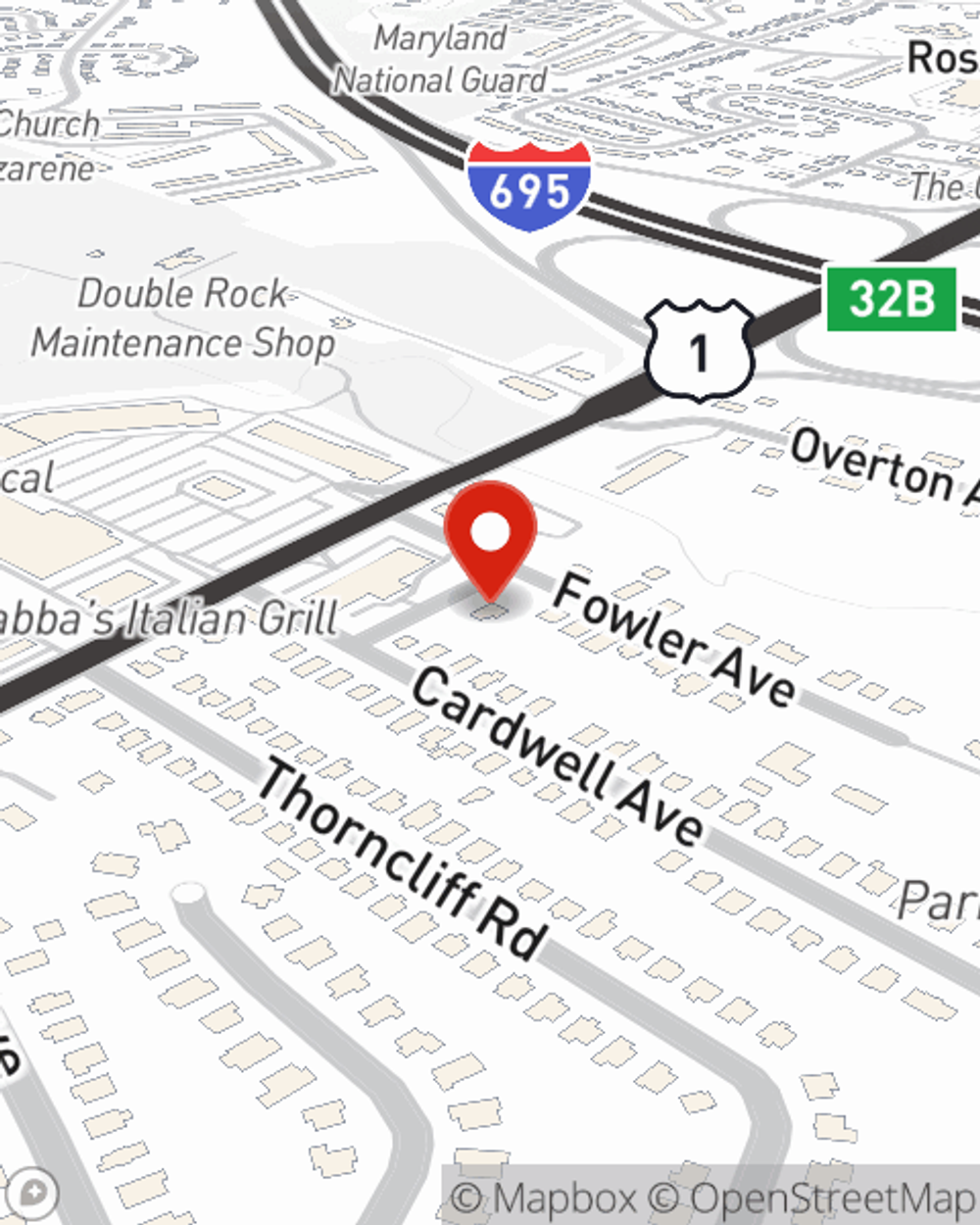

Agent Aja Green, At Your Service

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance is necessary for many reasons. It protects both your condo and your valuable possessions. If your condo is affected by a tornado or a fire, you could have damage to some of your belongings on top of damage to the townhouse itself. If your belongings are not insured, you might not be able to replace your valuables. Some of your possessions can be insured against damage or theft even if you take them outside of your condo. If your bicycle is stolen from work, a condo insurance policy could cover the cost.

Fantastic coverage like this is why Baltimore condo unitowners choose State Farm insurance. State Farm Agent Aja Green can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Aja Green can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Aja at (410) 882-9433 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.